Welcome back to the seventh edition of The New Defense Post!

In this edition, we’ll cover:

In the Hot Seat: We spoke with Matt Kuppers, Defence Invest Founding Partner and German Army Reserve Officer, about his journey from managing a consulting company to Defense Tech VC, his investment thesis, and his outlook on a potential European war.

Spotlights: Airports Across Europe Assess Stronger Counter-Drone Measures Amid Repeated Incursions; Helsing Will Acquire Australian Underwater-Drone Maker Blue Ocean; ICEYE Weighs New Funding at a ~$2.5bn Valuation as Investors Chase Europe’s Surging Defense Spend.

Fundraising News of the Week: Recent defense tech funding rounds include Govini raising $150mn for data-tech, HavocAI securing $85mn for maritime autonomy, and Hoverfly Technologies closing a $20mn Series B for tethered drone systems.

Bonus Section: We’ll look at autonomous fighter drones and how the US and Europe approach this concept.

In the Hot Seat

We sat down with Matt Kuppers, Founding Partner of Defence Invest and commissioned operations officer in the reserves of the German Army. Before becoming a defense tech VC, he founded his own consulting firm in London and later served in a German Army unit testing innovative systems.

We spoke about his past experiences, what it takes to start a defense tech VC fund, what he looks for in the Defense Tech space, and how he envisions a potential European war.

Spotlights

1. Airports Across Europe Assess Stronger Counter-Drone Measures After Repeated Incursions

Photo Credit: DEDRONE

Drone incursions are repeatedly shutting down European airports; disruptions and cancellations are spreading across Denmark, Sweden, Norway, and Germany since mid-September

At least 18 suspect drones have been spotted since Sept. 16, with signs of coordinated activity on certain days. Russia is suspected, Moscow denies it, and investigations are ongoing.

🗣 Enigma spokesperson: “The data indicates persistent activity over several weeks, and potentially coordinated incursions on specific days,” (Reuters)

📰 Our Take: The technology to counter them already exists, especially in Ukraine, including detection, jamming, high-power microwaves, and even lasers and missiles. But most “hard-kill” options are risky in dense civilian environments. Airports largely rely on detection gear from companies like Dedrone, Thales, and DJI Aeroscope.

We can expect spillover beyond airports: seaports, nuclear sites, and prisons are all vulnerable.

If you want to take a shot at tackling this challenge yourself, join us at the Counter UAS Hackathon we're organizing October 24-26 in Munich! Three days of working on ways to make our key infrastructure safer from drone threats.

2. Helsing Will Acquire Australian Underwater-Drone Maker Blue Ocean

Photo Credit: Helsing

Helsing will acquire Australian underwater-drone maker Blue Ocean, aiming to expand its AI-powered autonomous systems at sea. No transaction value was disclosed.

The company says the “strategic acquisition” enables it to combine Blue Ocean’s hardware and manufacturing capabilities with Helsing’s AI to accelerate the development and mass production of autonomous underwater drones for protecting maritime domains.

The deal is subject to court, regulatory, and shareholder approvals; a spokesperson said approval from the relevant authorities is expected within four months. It comes as European defence firms expand their naval capabilities due to increased government funding.

🗣 Amelia Gould, Helsing maritime GM: “The need for a smart autonomous mass-approach is clear, and together with Blue Ocean we can build an autonomous glider that provides a big leap forward to conduct underwater ISR (intelligence, surveillance and reconnaissance) for navies,” (Reuters)

📰 Our Take: Helsing has been actively utilizing the acquisition playbook to rapidly expand the number of products it can offer.

This approach can backfire, as acquisitions often come with complex integration challenges compared to building capabilities internally. However, it’s the playbook that all large primes are using to field new capabilities.

Given the urgency of securing a leadership position in the defense tech startup race, this might be the best way forward. Coming from being a pure software company, now they’re developing end-to-end capabilities across domains.

Hardware is hard, and the need to expand into hardware through acquisitions and partnerships reflects that reality.

3. ICEYE Weighs New Funding at a ~$2.5bn Valuation as Investors Chase Europe’s Surging Defense Spend.

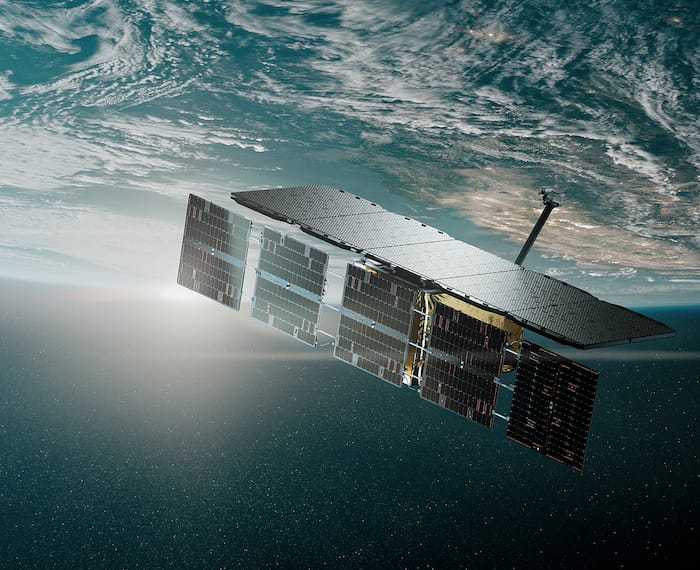

One of the ICEYE satellites. Photo Credit: ICEYE

ICEYE provides satellite-based synthetic aperture radar (SAR) imaging for real-time Earth observation and monitoring.

54 SAR satellites launched (≈$20mn each), with about half operated by national defense forces in the Netherlands, Finland, Brazil, and Portugal.

Work in Ukraine: it supplied imagery of Russian movements ahead of the February 2022 assault and signed a cooperation memorandum last year.

Their scale-up plan is ~25 satellites/year today, targeting 100-150/year, requiring substantial additional capital beyond the current investment.

📰 Our Take: If ICEYE prices a round near $2.5bn, it would cement the company as one of Europe’s defense-tech leaders.

Space is becoming increasingly important in defense. In Ukraine, satellite intelligence was key in spotting Russian movements at the beginning of the invasion. US and European “spy satellites” are still one of the main advantages Ukraine has when it comes to intelligence. (The Washington Post)

This success in bringing advanced observation satellites into space demonstrates that it isn’t just a game between large, publicly funded space agencies and state programs. Additionally, the cost of transporting payloads to space is decreasing, so expect some very interesting developments in this sector.

Other News

This Week’s Statistics

With Orlan-10 spotting a target, Russian artillery can strike in 3 minutes of detection; without drones, it can take around 20 minutes (T2COM G2)

Fundraising News

Amount | Name | Round | Category |

|---|---|---|---|

$150mn | Data-Tech for Defense Applications | ||

$85mn | Maritime Autonomy | ||

$20mn | Tethered Drone Systems |

Bonus Section — Fighter Drones

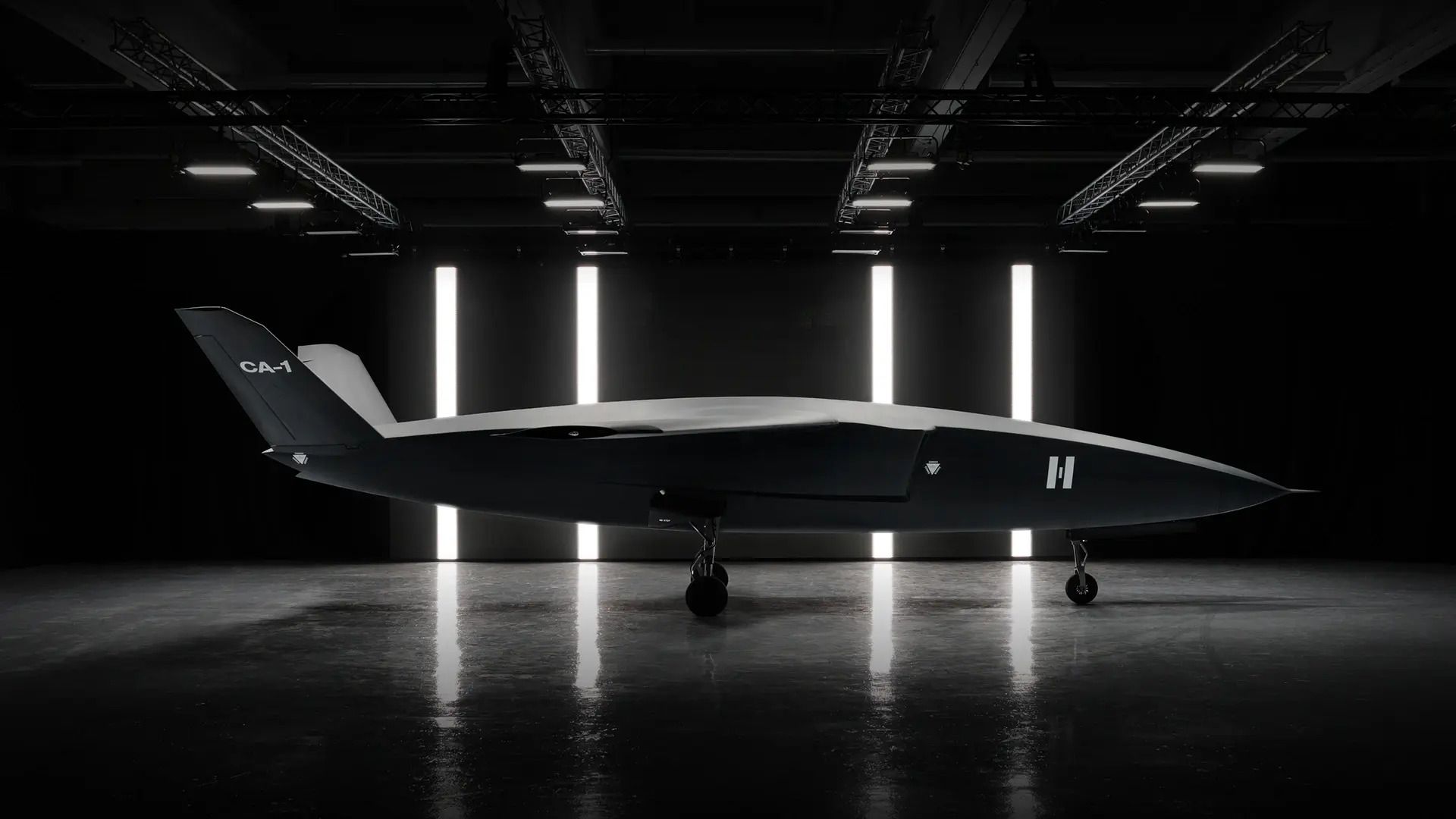

CA-1 EUROPA. Photo Credit: Helsing

There are two primary schools of thought when it comes to autonomous fighter jets. Collaborative Combat Aircraft (CCA) and fully autonomous drones.

Collaborative Combat Aircraft (CCA) are high-performance, fighter-class uncrewed aircraft designed to fly with human-piloted jets as part of a networked team. Instead of replacing pilots, they extend a crewed fighter’s reach by carrying sensors, jammers, decoys, or weapons while executing autonomous tasks such as scouting contested airspace, working as a decoy, or delivering payloads autonomously in deep-strike missions.

These drones are built to deliver modular payloads and communicate with each other through secure datalinks. CCAs use an onboard AI pilot to handle formation keeping, threat reactions, and route planning, while humans set objectives and rules of engagement.

The U.S. Air Force has formally designated the first two “uncrewed fighter” CCAs, YFQ-42A (General Atomics) and YFQ-44A (Anduril), and frames the concept around “affordable mass,” with a planned production of roughly 1,000 CCAs.

The US's main reason to keep the pilot in the loop is self-induced. DoD Directive 3000.09 explicitly states that autonomous and semi-autonomous weapon systems must be designed so commanders/operators can exercise “appropriate levels of human judgment” in applying force. That constrains “full autonomy” and favors human-in/on-the-loop teaming concepts like CCA. (DoD directive)

Fully autonomous systems are the approach that militaries outside the US are considering.

Helsing is one of the key players challenging the US producers in the high-end drone market. The company’s AI agent, “Centaur,” flying a Saab Gripen E in BVR combat trials, demonstrated rapid progress in fighter-grade autonomy. Their recently announced CA-1 Europa is the next logical step.

Dassault also had a demonstrator in development, the Neuron stealth combat drone. However, it appears to be in a relatively stagnant phase at the moment.

Not much is known about China’s autonomous fighter jet program except that it is quite extensive, with multiple systems showcased at their recent military parade. (Look at our past newsletter.)

Russia’s program appears to be quite advanced, but it is also experiencing delays and public embarrassments.

Full autonomy is the ultimate goal; AI pilots have already surpassed real pilots in simulated combat conditions, and the disparity is expected to widen in the future. Just thinking about a dogfight situation. A real pilot is limited by the amount of Gs they can withstand; a machine's only limit is in its hardware.

Love these insights? Forward this newsletter to a friend or two. They can subscribe on our website