Welcome back to the tenth edition of The New Defense Post!

Yes, it’s already been 10 editions — and many more to come!

In this edition, we’ll cover:

In the Hot Seat: We sat down with Yevhen Zhebko to learn how Teletactica is scaling battle-proven, resilient communications, just as the electronic threat continues to evolve.

Spotlights: Stark Receives Criticism Over Recent Field Trials; Germany Is Set to Award €900mn in Contracts for Loitering Munitions Between Three Players—Helsing, Stark, and Rheinmetall; China’s New Export Controls on UAV-Related Components.

Fundraising News of the Week: SalesPatriot raised €4.3mn in a seed round to automate defense procurement processes.

Bonus Section: Western Drones Underperforming in Ukraine.

In the Hot Seat

FPVs were a game-changer; it was difficult to keep them off the battlefield. Cheap, available in large quantities, the holy grail of modern battlefield, precision at volume.

We all know the story: €5mn tanks taken down by €300 drones, the frontline at a standstill because of the omnipresence of drones. It became nearly impossible to advance or mount any large-scale armoured operation. Then, the Russians became highly effective at electronic warfare, and radio-controlled drones started to lose effectiveness.

This is where Teletactica comes in. From field tests near Kyiv to an EU footprint for export and dual-use manufacturing, Teletactica is scaling battle-proven architectures while the electronic threat constantly evolves.

We sat down with Yevhen Zhebko, Teletactica's CEO and co-founder, to explore how they’re turning wartime improvisation into durable capability and what it takes to fund, build, and ship deep tech in a live EW environment.

We’re bringing the European Defense Tech community together for a one-day conference in Berlin—immediately following the European Defense Tech Hackathon

Over the past 16 months, European Defense Tech Hackathons have grown into a continent-wide movement: 16 hackathons, dozens of meetups, hands-on drone workshops, and field-testing days across Europe.

From these events, a new generation of defense innovators has emerged—builders who turned weekend prototypes into real companies. The New Defense Summit is where this momentum converges:

It’s your opportunity to meet our alumni in person, alongside startups, investors, and partners from the broader European Defense Tech community.

November 17, 2025, 9 am – 6 pm @Berlin

Sign up here: https://luma.com/new-defense-summit-2025

Preliminary agenda & more info: https://new-defense.com/summit/

Spotlights

1. Stark Receives Criticism Over Recent Field Trials

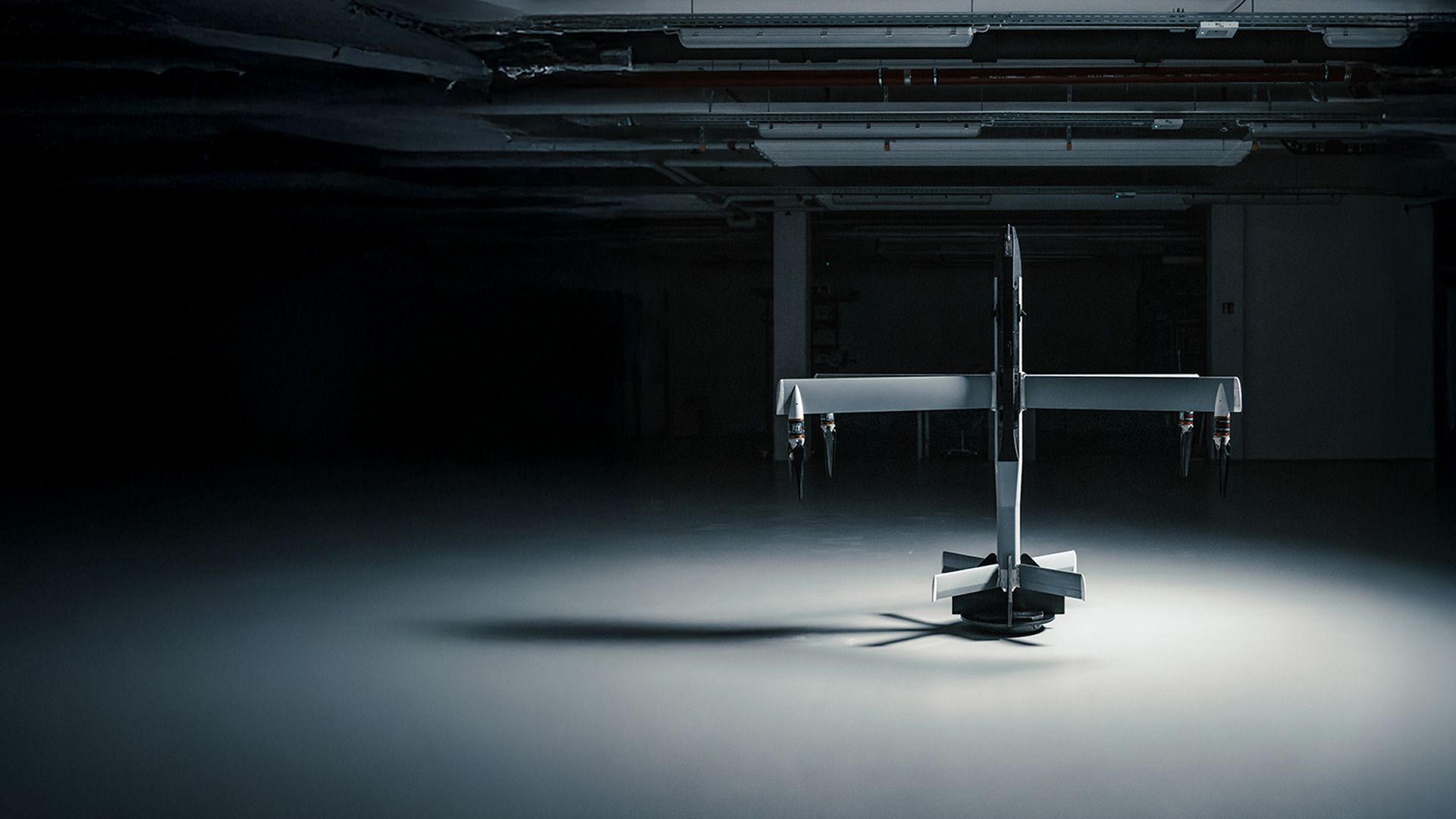

Photo Credit: Stark

Stark’s Virtus loitering drone—backed by Peter Thiel, Sequoia, and the NATO Innovation Fund—underwent British Army (Kenya) and Bundeswehr (Munster) trials in October.

Despite advertised specs (tracking/engaging targets to 100 km, 120 km/h cruise with dives to 250 km/h), four strike attempts missed in two separate trials;

One drone lost control in the woodland, and another’s battery ignited after an attempted impact. Rival Helsing HX-2 logged multiple successful strikes.

🗣 Stark spokesperson: “We did not crash once or twice, we have crashed a hundred times. That is how we test, develop, and ultimately continue to deliver defense technology like Virtus to the front lines in Ukraine.” (Financial Times)

📰 Our Take: There is still too little information to give a view on this issue. The field test was not successful, but was it actually a disaster? Startups work by iteration, and that’s a fact; you don’t deliver perfection immediately when you have to move fast. And there’s been just too much Schadenfreude this week.

2. Germany Is Set to Award €900MN in Contracts for Loitering Munitions Between 3 Players—Helsing, STARK, and Rheinmetall

The Hero Loitering Munition. Photo Credit: Rheinmetall

Germany is set to award €900M in contracts for loitering munitions, dividing the tender between three players—Helsing, STARK, and Rheinmetall—to supply up to 12,000 strike drones for NATO’s eastern defense.

Stark will supply its Virtus, Helsing the HX-2, and Rheinmetall the newly revealed FV-014 "Raider", a 5 kg payload drone with a 100km range.

🗣A German Official: “They’re doing it to keep the competition alive and make sure they get the best system,” (Financial Times)

📰 Our Take: This is a defining moment for Europe’s drone-industrial base. Splitting a €900mn order among two venture-backed start-ups (Stark, Helsing) and legacy giant Rheinmetall marks a strategic shift: hedging risk, pushing innovation, and accelerating procurement.

This contract could become the blueprint for competitive, hybrid procurement across NATO.

3. China’s New Export Controls on UAV-Related Components

Photo Credit:Come Back Alive Foundation

China’s new export controls on UAV-related components—including engines, batteries, and autopilot systems—are aimed at slowing Ukraine’s drone production. (NTV)

The move follows a wave of successful Ukrainian drone strikes and is seen as a strategic effort by Beijing to limit a key military advantage.

Ukrainian drone makers now face blocked shipments via EU intermediaries and are racing to localize production and diversify supply chains.

📰 Our Take: Ukraine’s drone sector (valued at $35–40bn across 800+ companies) now sits at a crossroads: either build a Europe-backed industrial base or risk production bottlenecks that could disrupt battlefield momentum.

Currently, there is a strong Ukrainian push to localize the production of such systems, with 40% of components now produced domestically (Defender Media). This should serve as a model for Europe as well—relying on China for cheap electronic components is a vulnerability that will come back to haunt Europe if left unanswered.

It’s not a matter of if, but when China will use this dependency as leverage.

Other News

Fundraising News

Amount | Name | Round | Category |

|---|---|---|---|

€4.3mn | Defense Procurement Automation |

Bonus Section — Western Drones Underperforming in Ukraine

Photo Credit: MAXAR

Western loitering munitions that once looked cutting-edge—like America’s Switchblade—have struggled in Ukraine, where cost, resilience to Russian electronic warfare, and real destructive effect matter most. Ukrainian developers and operators have raced ahead by iterating rapidly at the front, treating the battlefield as a live test field and prioritizing relevance over refinement.

The result is a clash of doctrines: Western systems optimised for limited, exquisite missions versus a “total,” high-pace fight dominated by cheap FPV swarms and quantity over quality.

In this environment, disposability and scale beat quality; it makes little sense to field a few six-figure ground systems when Ukrainian near-equivalents can be built for a tiny fraction of the price.

As said by Eduard Lysenko, a member of BRAVE1: “It’s like choosing between BMWs and Skoda Octavias.”

That pragmatism shows up in designs like the Blyskavka, a low-cost fixed-wing drone reverse-engineered from Russia’s Molniya and now in serial production, which brings meaningful payloads on extremely low budgets.

Firms that embedded early in Ukraine and iterated with troops—such as Quantum Systems—have done better. Yet financing still lags reality: NATO spending is rising, but much of it flows to legacy programs ill-suited to this war, while Ukrainian capacity sits on the sidelines despite its battle-tested success.

The stance toward Ukrainian tech is changing, as recent deals—such as the production of Ukrainian interceptor UAVs in the UK—demonstrate. But we’re still not there when it comes to learning from them or buying at scale what works.

The broader lesson is stark: if defense companies and governments aren’t deeply engaged in Ukraine’s rapid drone evolution, they risk being outpaced by a wave of cheap, scalable autonomy that could overwhelm any unprepared force.

Love these insights? Forward this newsletter to a friend or two. They can subscribe on our website